This news is a finished knowledge into the February finishing process dates for finishing charge year Code 150 on IRS Transcript 2022.

Have you seen the records of handling dates under the wages account?

Table of Contents

To find out about the records and wages records, read underneath for additional.

Clients from the United States have encountered a further take update in the issue, which skiped back to the first date for finishing the resequencing of the report produced from 28 February 2022.

As a handling thoughts banner return 14 February 2022 Monday has been the last date for the cycle on the diagram.

Our specialists have likewise referenced explicit Code 150 on IRS Transcript 2022.

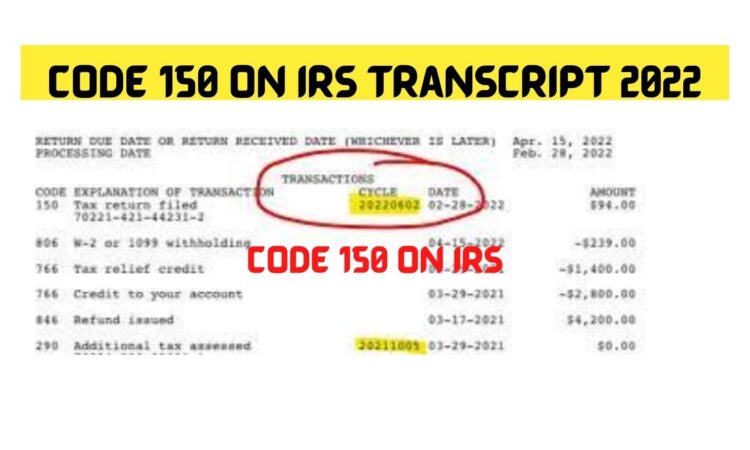

About Code 150 IRS Transcript

Code 150 states the duty discount won’t be determined on a record with 0.00. Matching the line for records in 24 Coronavirus 50 is a specialized paid zero assessment situation over the pay.

So a client with a lower pay can get zero tax reduction assuming he is able to work out the lines 27, 28 and 29 for a refundable expense for youngsters.

As a refundable credit, individuals can’t look for a Max measure of 10,000 dollars or eliminate the personal expense to profit of this advantage.

Peruse beneath for more information on Code 150 on IRS Transcript 2022.

Code 150 Date of Payment

Somebody who has gotten an E record status of 150, a duty discount document under 792 114 6709 781 at any sum more than $1, won’t get a discount.

Nonetheless, assuming individuals have held the alarm button for getting that entrance, they can visit our duty division to guarantee it back before 15 June.

The IRS people group talks about the duty liabilities that have been laid out in a straightforward way with the records to code 846, which is not generally seen yet changed over to code 150 out of 2021.

According to Code 150 on IRS Transcript 2022, clients keep up with consistence for an inward support discount.

Instructions to Claim

According to the IRS cycle week, the season’s fifth week is loaded up with the schedule dates to get accounts posted with direct store dates for their profits and discounts.

Likewise, there are explicit ways of guaranteeing full-time code:

- Document the assessed record to the US IRS entry 2021 duty record the return document will be made electronically to you

- The next year, before 28 February, the handling dates of the shower cycle will make a get of the exchange as assessment responsibility once again to you.

Code 150 on IRS Transcript 2022 Benefit

According to audits and a progression of recordings, it obviously shows that code 150 is an assessment applied on the saved portion of an authorize individual.

The client gets the return essentially by guaranteeing it to the public authority minus any additional liabilities and a rate deducted.

End

Taking everything into account, our specialists say that calculations in the authority discount, dates of the records for the code 150 is consequently demonstrated.

Do you know the IRS manual for handling government forms?

Remark underneath your perspective on the date 14 February 2022 records delivered by the handling and record Code 150 on IRS Transcript 2022.

Also Read- Advantages And Disadvantages bottled and jarred packaged goods 2022!