Subsequent research on Form W9 2022 will guide the significance, methodology, and reasons for individuals to complete this form.

Will you pay taxes? If you are a taxpayer, you should have heard of Form W9. And if you do not know this form and why it is used, this post was created for you. Some people in the United States know about this form, while many of you do not know about Form W9 2022. So if you are one of them, read this article to the end.

This article will walk you through why this form is used and when it was issued. So if you have trouble filling out Form W 9, take a look at this post.

About the W9 form

Table of Contents

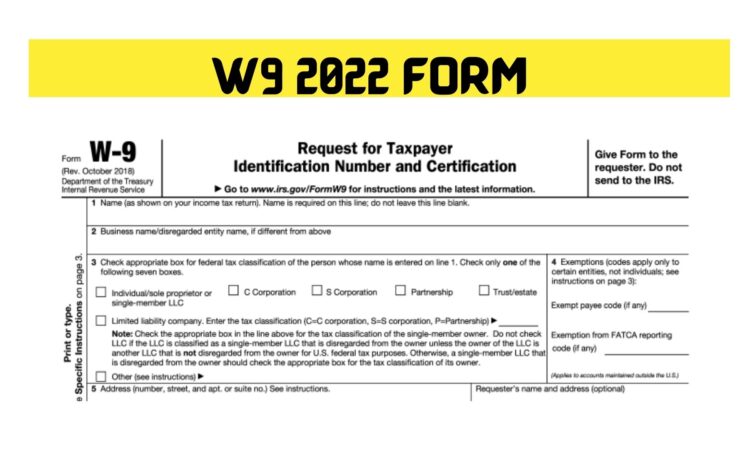

Form W9 is required to enter the correct TIN (taxpayer identification number). Therefore, if you need to submit information to the IRS and obtain the correct VAT number, you must complete this form. This form can also be used to verify the taxpayer’s real name, address and other important information, such as VAT number.

Where can I get Form W9 2022?

- You can visit the official US Tax website and use the W9 form to get many options. You fill out the form very quickly.

Who asked you to fill out a W9 form?

Any person or company can ask you to meet the requirements on the W9 form. If you pay for your work, you may need to provide all the details and the applicant may not submit a Form W 9. A person may use this form to complete additional requirements or to complete other IRS forms, such as Form 1098, etc. Form W9 2022 is used to collect personal information required by each company you work for.

Critical points of form W9

- This form requires a company that must pay its employees to collect their personal information, such as name, address, TIN. They may include people such as freelancers, contractors, suppliers, etc.

- If you do business with another company, Form W9 may want to verify your information such as address, taxpayer security number, name and other valuable information.

- Another reason to submit a W9 form is that you are involved in most tax transactions that need to be recorded and reported to the IRS.

- Form W9 2022 does not have a deadline, but most tax forms begin on January 31, 2022.

How do I write W9?

- You must enter your name first. Enter the LLC name when submitting the owner.

- When sending as a company, enter the name of your company.

- Select the appropriate federal tax classification.

- If you are applying as a natural person, you do not have to fill in the exceptions. • Other information to be filled in is address, postcode, star, account number, tax identification number.

- Finally, you must confirm all the details.

Conclusion

Packed in the form of W9 2022, we share all the important details. You will find out how to fill in the form correctly and who is needed to fill in this form. For more information on the W9 form, see the following link. Want to share your views on the IRS W9 form? Share your thoughts in the comments section below.

Also Read- How Long To Get Tax 2022 Refund (Feb) Get Full Details Here!